Tobacco and Fuel Tax Exemption Simplification Project (TAFT)

The B.C. Ministry of Finance launched a multi-year project to modernize and replace the current paper-based exemption process for the tax-exempt sale of tobacco and fuel made on First Nations reserve land in British Columbia.

The objective was to improve the service experience for First Nations customers when making tax-exempt tobacco or fuel purchases while streamlining the process for retailers by eliminating the paper-based documentation process for capturing sales. The system should also deliver real-time electronic verification of eligibility, making record-keeping efficient for retailers. For the Ministry, the system should provide tools for special authorizations and an electronic dashboard of purchases made by customers and tax-exempt sales reports of retailers.

About the TAFT Application

The project's core objective revolved around the creation of a novel electronic point-of-sale (PoS) verification and documentation system named TAFT. This innovative solution empowers retailers with a dedicated PoS system, specifically designed to operate on government-supplied iPads. This system functions to electronically validate the eligibility and seamlessly document tax-exempt sales of tobacco and fuel in real time. Moreover, a web-based application is also accessible and compatible with existing hardware.

For its operation, the TAFT system requires internet connectivity, allowing it to efficiently record sales transactions even in offline scenarios. Once connectivity is reestablished, all recorded offline sales are promptly updated across the system's records.

Results

As of August 2023, since the initial installation in (Month and year), we have successfully onboarded (x out of y) retailers onto the solution. During this period, our system has facilitated over 300,000 sales transactions.

50

Retailer Installations

300,000+

Sales Transactions

My Role

In January 2021, I became a member of a cross-functional product team comprised of full-stack engineers, a technical architect, a business analyst, and a project director. In my capacity as the Senior Designer for the project, I took charge of leading user research and driving the design discovery process through collaborative workshops. My responsibilities encompassed creating user journeys and empathy maps, drafting wireframes for multiple conceptual iterations, and ultimately delivering detailed high-fidelity designs and prototypes.

Working in close coordination with the engineering team, I ensured a smooth integration of my designs by providing them with components based on the B.C. Design System, along with data specifications to facilitate the development of high-fidelity prototypes.

A significant part of my role included engaging with the Ministry, where I effectively presented our research findings, conducted prototype demonstrations, showcased product builds, and played an active role in the process of prioritizing backlog items that held substantial implications for the project's development roadmap.

Business Challenges

The current paper-based exemption process proves to be arduous for retailers, leading to significant delays in the submission of tax-exempt sales records.

Verifying the eligibility of purchases made by First Nations customers presents a cumbersome experience.

A lack of an effective tracking mechanism in cases of misuse of status numbers.

Concerns around privacy arise due to customers' personal information being exposed on paper documents.

The Ministry grapples with a large volume of paperwork, as sales data is manually input into spreadsheets, resulting in human errors and inefficient record keeping.

Business Goals

Replace the outdated paper-based system currently employed by retailers with an automated digital solution, effectively eradicating delays in the monthly filing process.

Develop a robust solution that ensures tax-exempt sales are exclusively conducted for First Nations customers.

Incorporate a solution to prevent instances of exceeding purchase limits.

Enhance the protection of First Nations customers' identities by eliminating the utilization of paper documents that expose their personal information to the public eye.

Integrate reporting tools and an electronic dashboard into the solution, enabling the Ministry to monitor individual transactions as well as bulk sales from retailers.

Discovery and User Research

The discovery phase for TAFT presented a notable challenge, as the product team and stakeholders operated remotely across disparate time zones, further compounded by the COVID-related restrictions that limited our access to users. With on-site field studies and direct observation of users interacting with the current system proved challenging amidst lockdowns, our initial information source relied heavily on insights from the Ministry.

Compensating for these challenges, we sifted through a vast repository of data amassed by the Ministry over the years. This data originated from retailers and First Nations bands and was acquired through numerous announcements, anonymized surveys, and outreach initiatives that introduced the concept of an electronic system for tax-exempt sales. This data helped us to identify our three core user groups – Retailers, First Nations Customers, and the Ministry of Finance.

Given the task of constructing a solution from scratch, our team recognized the necessity of understanding the complexities inherent in retail operations. To achieve this, we enlisted the Ministry's assistance in connecting us with retailers who were willing to actively contribute to the development of a tailored solution. This collaboration led to the establishment of the Retailer Engagement Program in late March 2021, wherein participating retailers became integral partners.

Using online or phone interviews, we engaged with these retailers to grasp their specific business requirements, limitations, apprehensions, and frustrations tied to the existing procedures. Over time, these dedicated retailers transformed into the early adopters of the new TAFT application.

Throughout this insightful process, it emerged that the retailers largely adhered to a similar approach for conducting paper-based tax-exempt sales, albeit with minor inconsequential variations.

However, our exploration also revealed several crucial variables inherent to the functioning of a retail environment.

Difference in store ownership and management structure

From a garage-operated store with one owner to multi-tier organizations where employees have defined roles and responsibilities.

Volume of sales, size of a store and number of retail staff

Volume varies from low to high depending on their assigned quota. Stores can be big establishments where they serve a large number of customers with retail staff working on multiple tills.

Location

Varies significantly from stores situated in easily accessible urban areas to those located in remote regions where unreliable critical infrastructure adversely impacts their business.

Access to technology

Have access to a stable and reasonably fast internet connection, as well as be comfortable with utilizing various devices and digital applications that employ cutting-edge technologies.

Operational hours

In some instances, retailers continued to serve customers even after the store was officially closed.

Safekeeping of goods

In some locations, retailers implemented additional measures to prevent the misuse and theft of their products.

Communication channels

For support and reporting disputes and grievances

Ideation, Design and User Testing

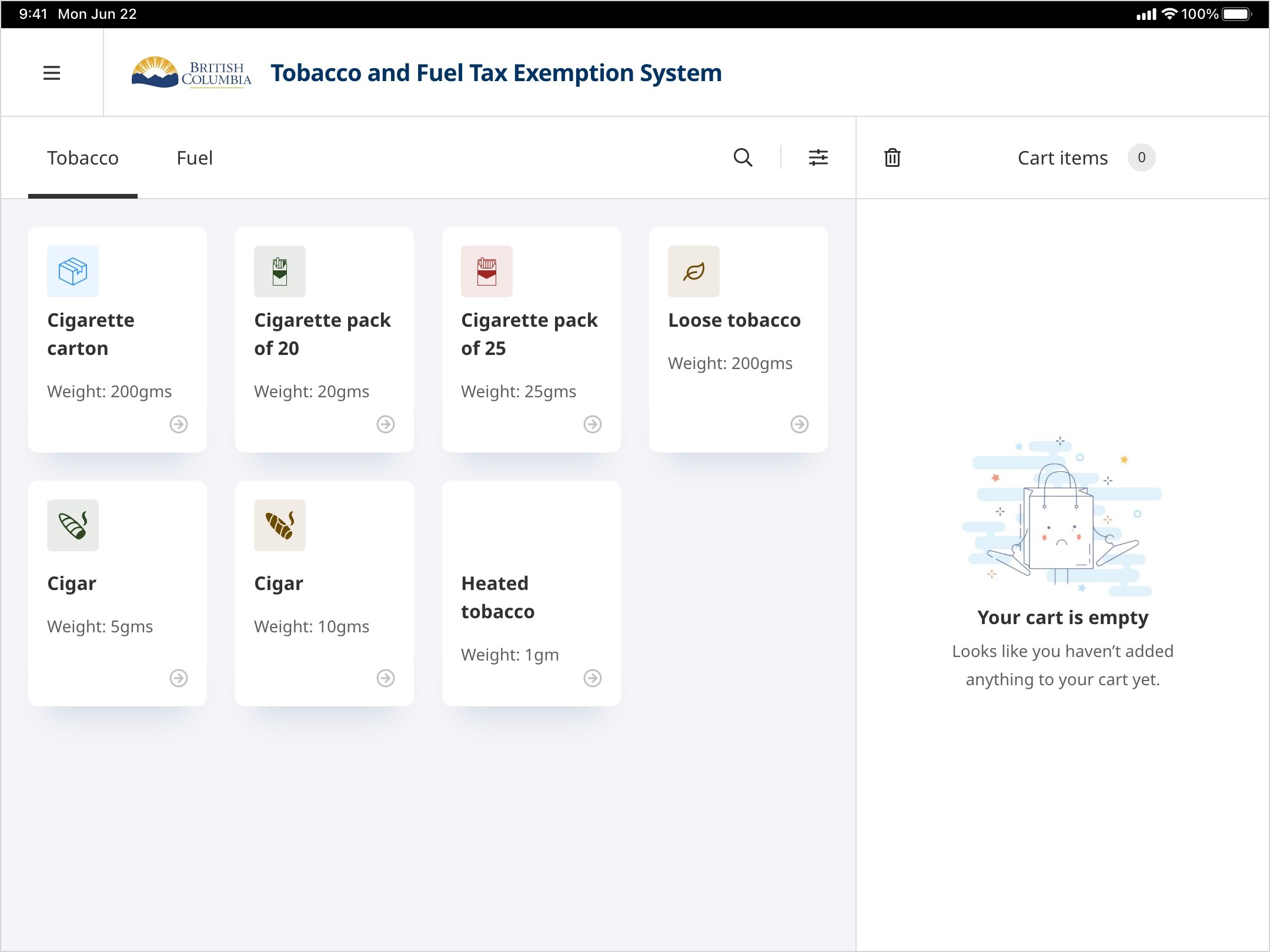

Our initial approach involved modelling our design after e-commerce websites featuring product images. We aimed to create a shopping experience akin to traditional retail, complete with a shopping cart feature that would allow staff to add multiple items during the checkout process.

As we progressed, we sourced generic product images. While the concept of incorporating images was received well by retailers, they expressed a preference for brand-specific imagery relevant to the products they stocked. We could have resolved this through product photography, but we encountered an obstacle – The Ministry's reluctance to showcase or promote tobacco items through elaborate visuals.

Furthermore, an additional challenge emerged – the variance in brands stocked by different retailers. Creating tailored inventory for each brand was not within the parameters of the project.

To simplify the interface, we opted to replace images with product cards. The primary brand colour was used to enhance the focus on these product cards. We intended to rely on retail staff to read and comprehend the product details from these cards. However, during prototype testing, we observed a lack of clear differentiation between these cards. This confusion led to delays and difficulties among retail staff when attempting to select the appropriate product for adding to the cart.

Additionally, we noticed that within the dynamic context of retail, the staff heavily leaned on product recognition within their existing PoS systems. Despite the basic nature of the interface on these systems, it effectively fulfilled its intended purpose. As a result, we adjusted our design strategy to craft a solution that mirrored a PoS system. This shift aimed to align with the cognitive framework of our users.

To emulate the PoS experience, we engaged in multiple cycles of iteration and user testing. Throughout this process, we explored various iterations for the design of the product cards. Ultimately, after thorough refinement, we successfully arrived at a solution that aligned with our users' needs and expectations.

A shopping experience akin to traditional retail, using generic product images.

Finalized User Interface for the Product Screen

In our initial effort to streamline the interface, we incorporated the primary colour for product cards while retaining the "Add to cart" button.

Ministry Reports

Adjudication Error Messages

Given our real-time adjudication of status numbers, we implemented a prominent error message display on the screen whenever an ineligible status number attempted to make a purchase. This strategic adjustment was made to alleviate the responsibility placed on retail staff to explain why a customer's number was not accepted by the system. By making the error message highly noticeable, we aimed to enhance clarity and reduce potential customer confusion or staff intervention.

Throughout the numerous rounds of iteration, we delved into various versions of the product card design, continuously refining our concepts based on user testing outcomes.

Usability Improvements

As we advanced in developing the solution, we confronted several design challenges. Some of the key ones are outlined below:

Numpad, Buttons, Input Fields and Legibility

In response to user feedback, we addressed their concerns about the need for precise inputs by enlarging all buttons and input fields. Additionally, we recognized that the legibility of the status numbers, particularly during number entry, posed a challenge. To remedy this, we revamped the num pad design, incorporating larger buttons and adopting a calculator-style appearance. This modification aimed to enhance user experience and readability.

Accuracy of Customer Information

Retailers voiced apprehensions regarding the accuracy of information presented on status cards. Their interest extended to gaining visibility into a customer's eligibility, encompassing instances such as underage sales of tobacco products. Adhering to the guidelines stipulated in the Privacy Impact Assessment set forth by the government, we navigated a balanced approach. This approach allowed us to present relevant information to retailers without compromising the potential for misuse or unauthorized access.

Enhanced Fuel Interface

Responding to user feedback, we developed an interface to address their desire for a method to modify the fuel type in case of accidental selection errors while checking the tax-exempt price for fuel or completing a sale. This new design element enables seamless adjustment of the fuel type and enhances user control and convenience.

OCR Capability

Given that the central purpose of the system is to authenticate status card numbers, we implemented an Optical Character Recognition (OCR) feature. This empowers retail staff to use the front-facing camera of the iPad to scan status card numbers for validation. In situations where the system encounters difficulty reproducing an exact number, we retain the manual input option to allow for adjustments. The introduction of this OCR capability has garnered enthusiastic feedback from our users, significantly enhancing efficiency and saving them valuable time.

Project Summary

Under the paper-based system, the Ministry had to retain all tax-exempt sales records documented on physical sheets for a minimum of 7 years. In the process of digitizing these records, the Ministry resorted to manual data entry into spreadsheets which was prone to human errors leading to inefficient record-keeping. Despite the conversion to digital format, the Ministry had no insights into individual and retail sales metrics, leaving them unable to verify eligibility, detect potential misuse of status numbers, or monitor compliance with tax-exempt limits.

One of the business goals of the project was to provide an electronic dashboard and a series of summarised and detailed reports that the Ministry could filter and sort based on their requirements. Beyond sales-related reports, we also created reports for denied adjudications and high-volume fuel sales, aimed at flagging instances that could indicate potential misuse of status numbers.